These funds are maintained as reserves since money makers require less investment. The funds, therefore, can be used to finance new projects, innovation, and expansion. In this article, we analyze products, but the BCG Matrix can also be used to evaluate individual business units (called Strategic Business Units ) or any other cash-generating assets, such as property.

The Boston Matrix is a tool which can help in making these decisions. To grow, you need to invest in your assets.The added cash required to hold shares is a function of growth rates. A company that holds a moneymaker position needs to adopt strategies including careful budgeting, marketing, prioritizing, and innovation. This way, the company can keep generating cash flows out of it. Management has to decide if investing in a problem child’s business will increase market share enough to turn it into a star. A problem child could turn into a dog even after burning money.

What do stars represent in BCG?

Products in the cash cows quadrant are in a market that is growing slowly and where the product have a high market share. Products in the cash cows quadrant are thought of as products that are leaders in the marketplace. The products already have a significant amount of investments in them and do not require significant further investments to maintain their position. As the market matures and the products remain successful, stars will migrate to become cash cows. Stars are a company’s prized possession and are top-of-mind in a firm’s product portfolio.

These companies are mature and do not need as much capital to grow. They are marked by high-profit margins and strong cash flows. Cash cows can also be slow-growth companies or business units with well-established brands in the industry.

A mutual fund is an investment vehicle consisting of a portfolio of stocks, bonds, or other securities, overseen by a professional money manager. In a business sense, a portfolio simply means the range of products sold by a business. The Dogs of the Dow strategy attempts to maximize the yield of investments by buying the highest-paying dividend stocks available from the DJIA each year.

- Helpful for managers to evaluate balance in the firm’s current portfolio of Stars, Cash Cows, Question Marks, and Dogs.

- If a star can maintain its large market share, it will become a cash cow when the market growth rate declines.

- It was launched with the motive to offer consumers relatively healthier beverage option in terms of calories consumed.

- This is especially true with product lines at different points in the product life-cycle.

- In the Boston Consulting Group matrix, cash cows are placed in the bottom right position—high market share but low growth rate.

Question marks are the business units experiencing low market share in a high-growth industry. They require large amounts of cash to capture more of or sustain their position within the market. Depending on the strategy adopted by the firm, question marks can land in any of the other quadrants.

Over the course of thousands of years, gravity causes pockets of dense matter inside the nebula to collapse under their own weight. One of these contracting masses of gas, known as a protostar, represents a star’s nascent phase. Because the dust in the nebulae obscures them, protostars can be difficult for astronomers to detect.

What is Cash Cow Definition in the BCG Growth-share Matrix

A dog is a business unit that has a small market share in a mature industry. A dog thus neither generates the strong cash flow nor requires the hefty investment that a cash cow or star unit would . Cash Cows – Cash cows are leaders in a more mature market. These are successful products that enjoy a large market share in a well-established market. Since a cash cow demonstrates a return on assets greater than the market growth rate, it generates more cash than it consumes. These products should be ‘milked’ by extracting the profits and continuously managing them so that they keep generating strong cash flows, which can be further used to fuel stars.

For investors, “Dogs of the Dow” is an investment strategy that attempts to beat the Dow Jones Industrial Average each year by leaning portfolios toward high-yield investments. The general concept is to allocate money to the 10 highest dividend-yielding, blue-chip stocks among the 30 components of the DJIA. The BCG matrix can be useful to companies if applied using the following general steps. Strategic Business Units, individual brands, product lines or the firm as a whole are all areas that can be analyzed using the BCG matrix. The chosen unit drives the entire analysis and key definitions.

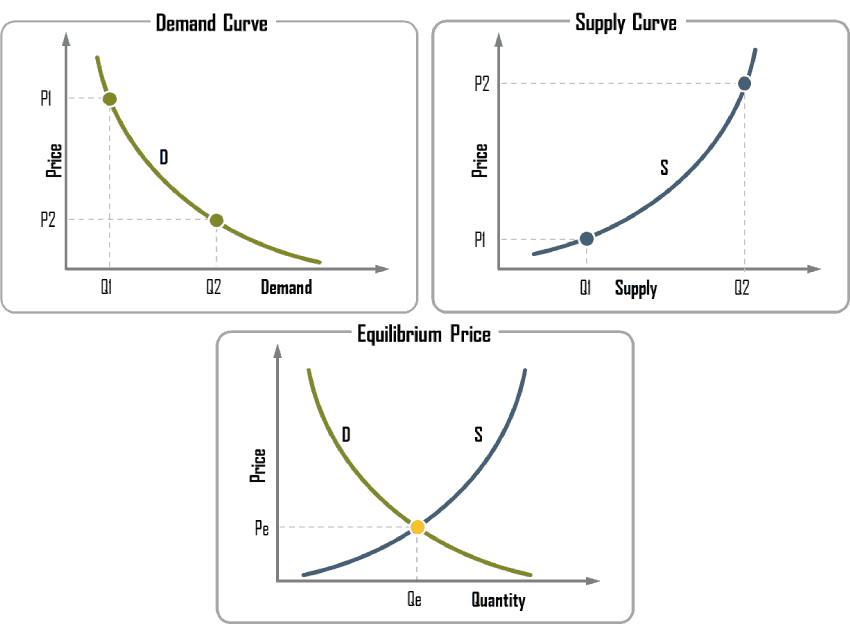

The BCG Matrix has its own limitations, since it’s a very simple tool using only two dimensions—market share and market growth. As a larger market share is attained, the yields of stars will increase. Market share is starting to level off for cash cows when yields are at their highest. Question marks are businesses that have a small market share in a high growth market.

Cash cows can be also used to buy back shares already on the market or increase the dividends paid to shareholders. They usually bring in cash for years, until new technology or shifting market preferences renders them obsolete. Moneymakers dominate the industry, which affects the other small players. Price Leadership refers to a situation where the money maker decides the price.

What do cash cows symbolize in BCG matrix?

A Cash Cow is a market leader that generates more cash than it consumes. Cash Cows are business units or products with a high market share but low growth prospects. Companies are advised to invest in cash cows to maintain the current level of productivity or to “milk” the gains passively. If a star can maintain its large market share, it will become a cash cow when the market growth rate declines. The portfolio of a diversified company always should have stars that will become the next cash cows and ensure future cash generation.

Investments in question marks are typically funded by cash flows from the cash cow quadrant. The assumption in the matrix is that an increase in relative market share will result in increased cash flow. A firm benefits from utilizing economies of scale and gains a cost advantage relative to competitors. The market growth rate varies from industry to industry but usually shows a cut-off point of 10% – growth rates higher than 10% are considered high, while growth rates lower than 10% are considered low. The lower-left quadrant of the matrix—the cash cow—was central to the framework. Cash cows are the strong competitive businesses that generate high levels of stable reported profits.

About Boston Consulting Group

When the total market demand grows to 150, your sales will also grow to 45, simply by maintaining your market share at 30%. A cash cow is one of the four categories in the growth-share, BCG matrix that represents a product, product line, or company with a large market share within a mature industry. Cash cows have a low growth rate but a high market share on the BCG matrix. It represents stable returns from money-making products, companies, product lines, or assets. Market growth, on the other hand, is used as a measure of the attractiveness of a given market. A growing market is basically a market experiencing increasing demand, which makes it easier for businesses to increase their profits, even if their market share remains unchanged.

Stars result in a large amount of cash consumption and cash generation. If a star becomes a cash cow, then an attempt to hold market share should be made. Coca-Cola’s bottled water called Kinley is an example of Stars.

These are products with a high market share but low growth prospects. Dog– a product that has a low market share and is in a low-growth market. The more reasonable option is to stop or divest this category. It is a fact that as the world adapts to a new reality—marked by uncertainty and a lack of euphoria—public corporations are once again what do cash cows symbolize in bcg matrix discovering that they need cash cows. So selling off these businesses to private equity investors—who pay high prices for them and leverage them to the limit—will no longer be the obvious answer. Indeed, it is likely that some of the cash cows that found their way into leveraged private holdings will return to public shareholdings.

Firms typically phase out products in the dogs quadrant unless the products are complementary to existing products or are used for a competitive purpose. Problem child is a quadrant in the BCG Matrix and is the triage category among the cash cows, stars, and dogs. A problem child is a business line that has good growth potential but a small share of the growing market. Cash cow– a product with a large market share and being in a low-growth market . This category has successfully dominated the market and requires relatively little investment.

The TOWS matrix can be used to maximize your external opportunities and minimize threats. The TOWS Analysis is an extension of the classic analytic tool. Strengths, Weaknesses, Opportunities and Threats are some of the words that are referred to as TOWS. The question mark is used to indicate an interrogative clause in many languages.

Recent Comments